Developed a streamlined online acquisition process for business banking customers in Egypt, focusing on automating document verification, enhancing digital assistance, and supporting multilingual interactions. This project aimed to improve user experience, reduce onboarding time, and increase customer satisfaction and acquisition rates.

Background

The banking sector in Egypt is evolving rapidly, with increasing demands for digital transformation to meet the needs of diverse business customers.

The traditional account opening process has been slow, manual, and often frustrating for users, particularly those facing language barriers or lacking digital assistance. In a market where efficiency and accessibility are key, there was an urgent need to overhaul the business banking customer onboarding process to remain competitive.

Objectives

The main goal is transforming business customer online acquisition -in Egypt- for streamlined document verification and support multilingual Support

Seamless document verification

Implement a document verification system to reduce manual interventions and expedite document validation.

Target: Achieve a 60% reduction in document verification time while maintaining high accuracy and security standards.

Comprehensive digital assistance

Provide business customers with intelligent, user-friendly digital assistance throughout the account opening journey.

Target: Increase user completion rates by 35% by offering real-time support and guidance.

Empowering native language support

Implement robust multilingual support across the platform.

Target: Increase customer satisfaction by 20% among non-native Arabic speakers by offering seamless interactions in their preferred language.

All UI is displayed in black and white to abstract my visual skills and the main layout structure, as the original coloured version cannot be shown due to a non-disclosure agreement (NDA)

Discovery

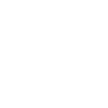

Problem statment

The current online account opening process for business customers in Egypt is inefficient, with manual document verification, lack of digital assistance, and insufficient multilingual support, leading to customer frustration, delays, and a high abandonment rate.

Challenge

The existing account opening process is plagued by several issues, manual submission and verification of documents lead to delays and errors; business customers struggle with the complexity of the process due to the lack of digital assistance, resulting in confusion and abandonment; and the absence of robust multilingual support limits accessibility, deterring potential customers from diverse linguistic backgrounds.

User needs

We assume that business banking customers in Egypt need an efficient and reliable way to submit and verify the required documents for account opening, minimizing delays and errors. They require clear, step-by-step guidance throughout the process to avoid confusion and ensure successful completion.

Additionally, we assume that users need the ability to interact with the platform in their native language, as language barriers could lead to misunderstandings and discourage them from completing the onboarding process.

Security is a top priority, so we assume that users need to feel confident that their personal and business information is handled securely.

Furthermore, we assume that customers expect the account opening process to be quick and convenient, with minimal manual input, and that they require real-time support and feedback to address any issues immediately and enhance their overall experience.

Research

User research

Methods

Conducted surveys, interviews, and usability testing sessions to understand the pain points of business customers during the onboarding process.

Key Findings

The research revealed that users were frustrated with the time-consuming document verification process, lacked sufficient guidance, and struggled with language barriers.

Competitive analysis

Benchmarking

Analysed the onboarding processes of competitors in the Egyptian market, focusing on digital assistance and multilingual support. Competitors with advanced automated solutions had higher user satisfaction and lower abandonment rates.

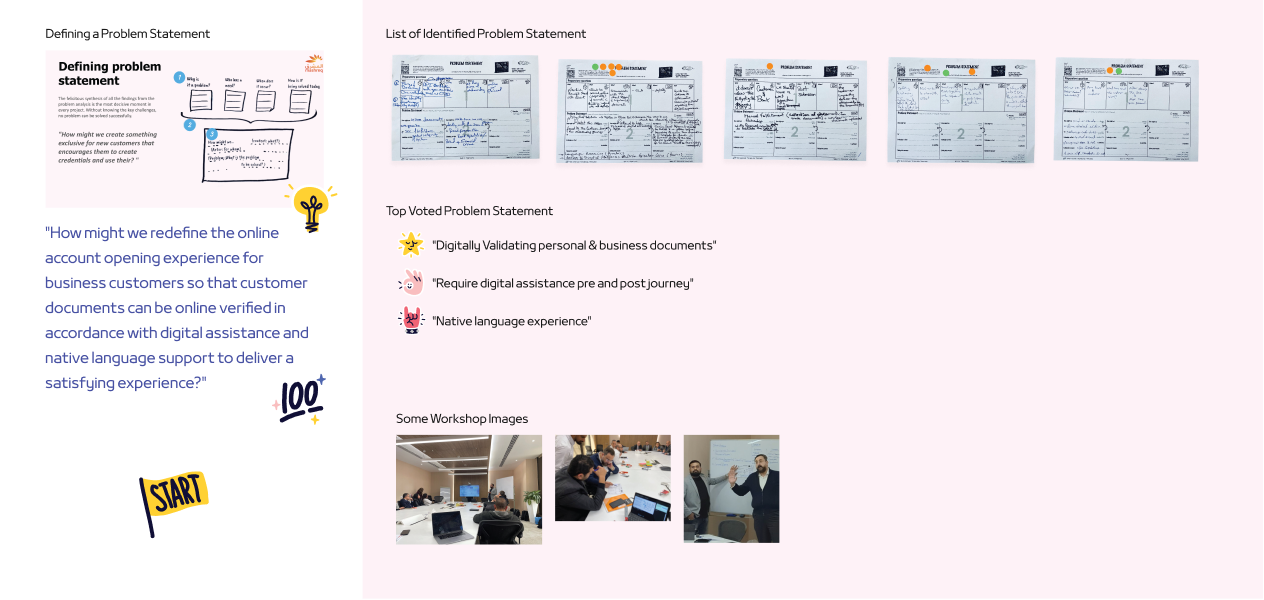

User personas

Detailed personas

Created personas representing business customers of different backgrounds, highlighting their specific needs for faster document verification, clearer guidance, and language support.

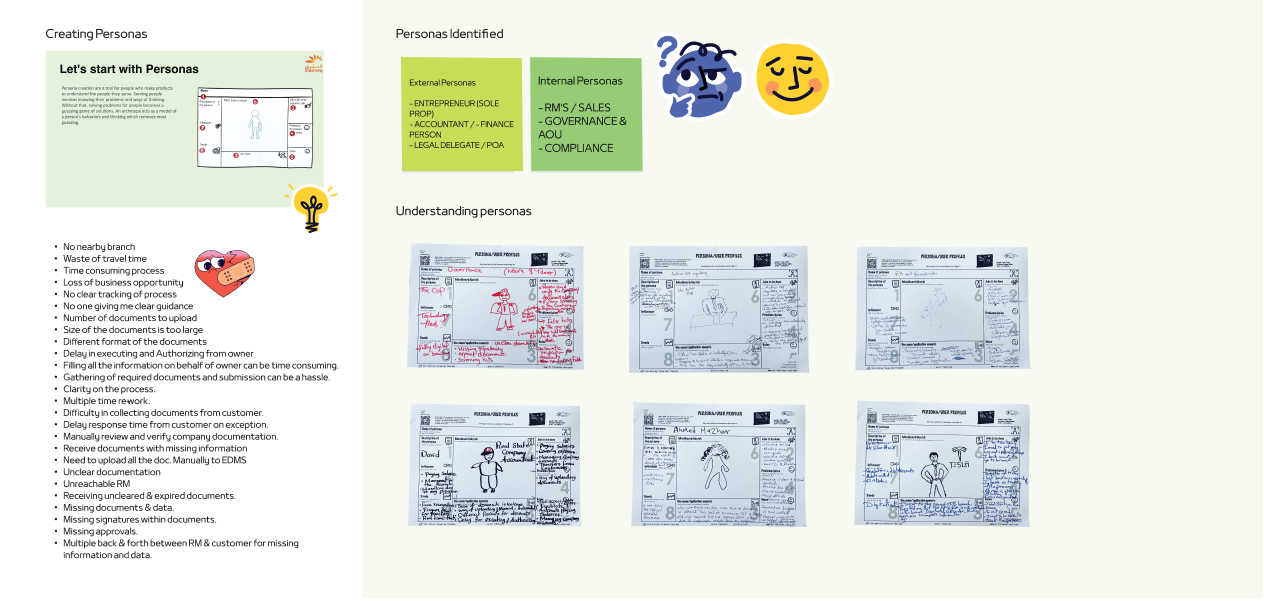

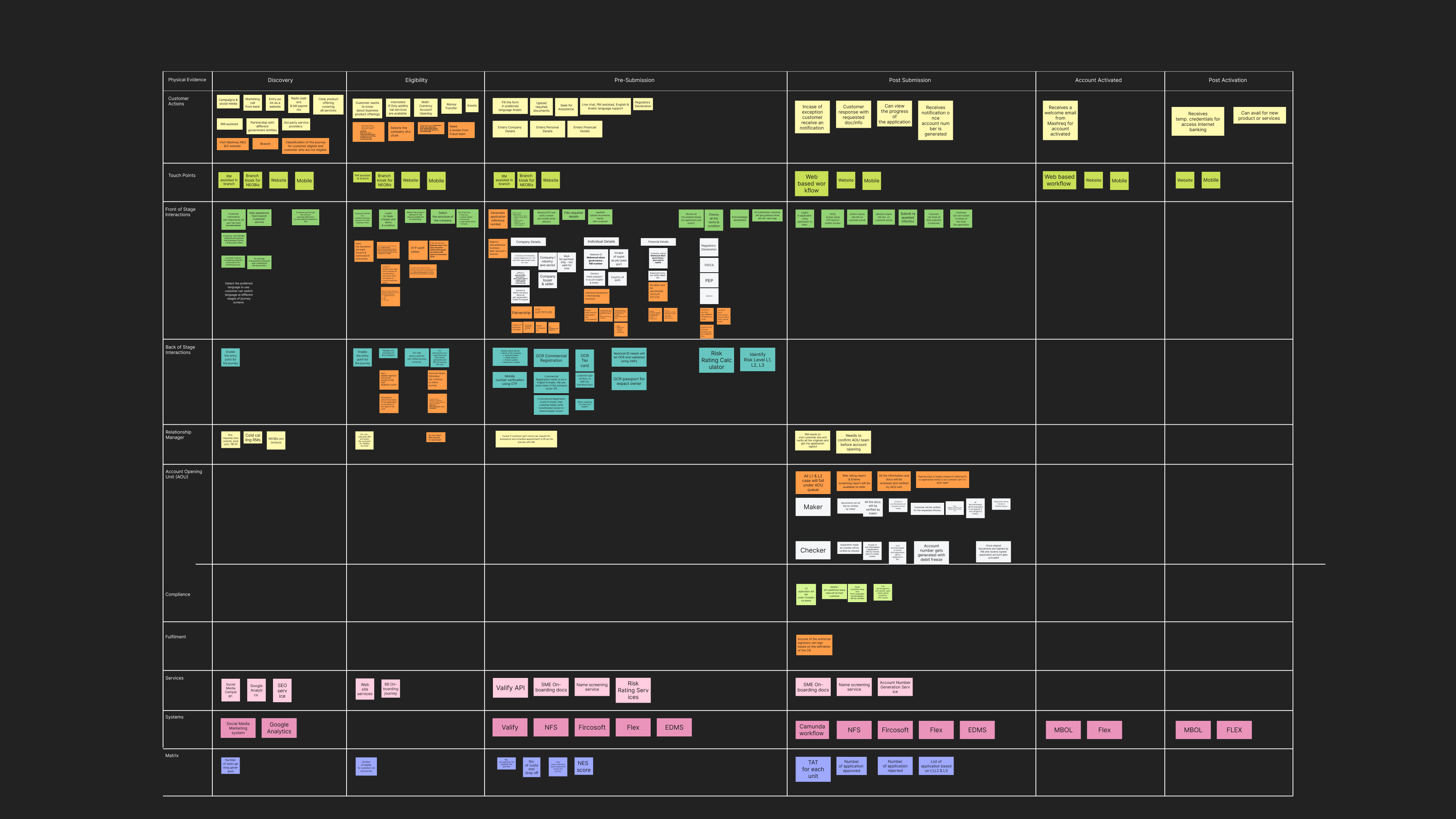

User Journeys

Mapped the steps involved in the onboarding process to identify critical touchpoints where improvements were necessary, such as document submission, verification, and customer support.

Solution

Ideation and Conceptualisation

Brainstorming Sessions

Initial ideas and concepts were generated through collaborative brainstorming sessions with the team. These sessions focused on innovative solutions to address the identified user pain points, such as manual document verification, lack of digital assistance, and language barriers. The team explored various approaches, including the use of intergrated systems for document verification, the integration of a digital assistant, and the development of a multilingual interface to enhance the overall onboarding experience for business banking customers in Egypt.

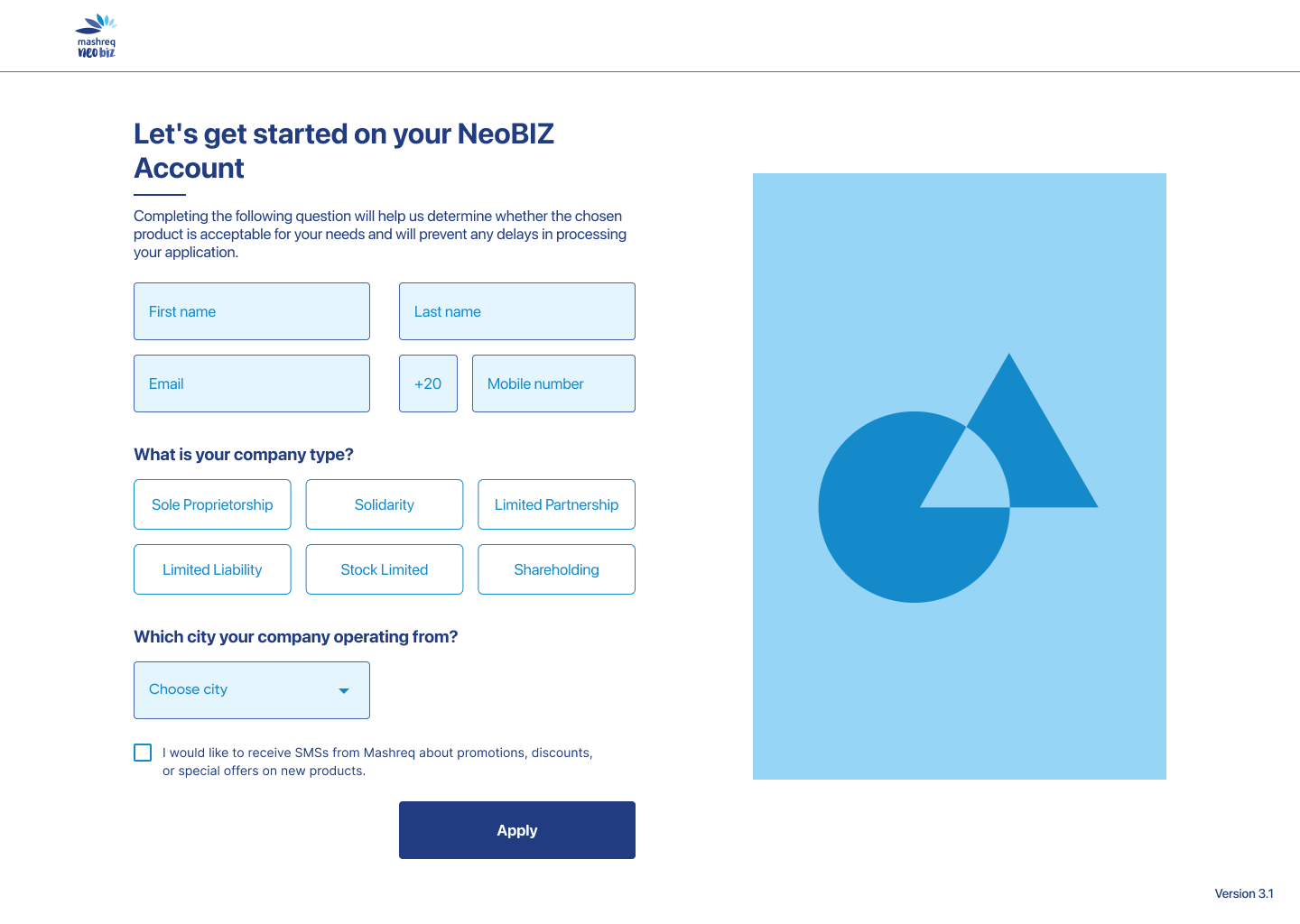

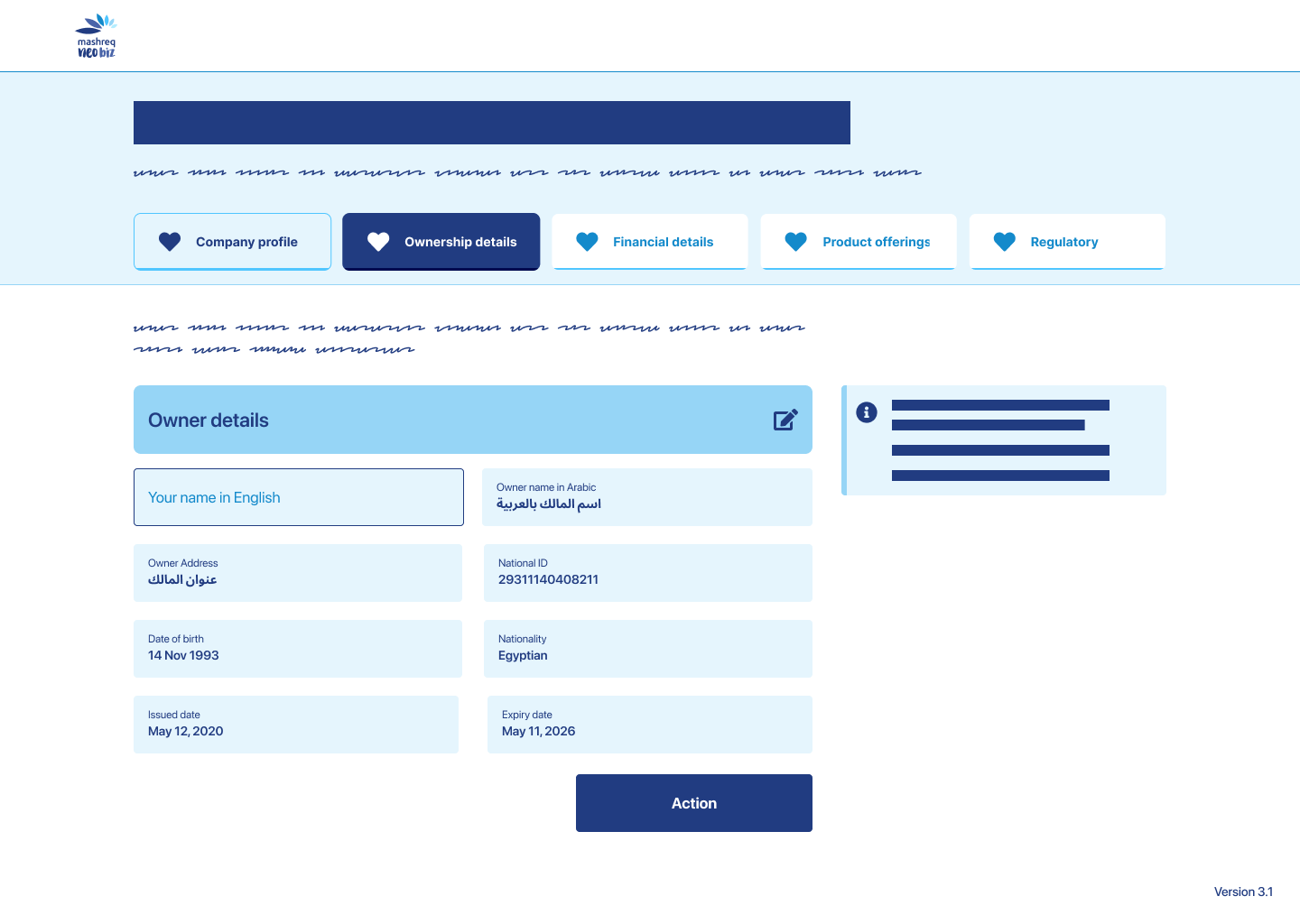

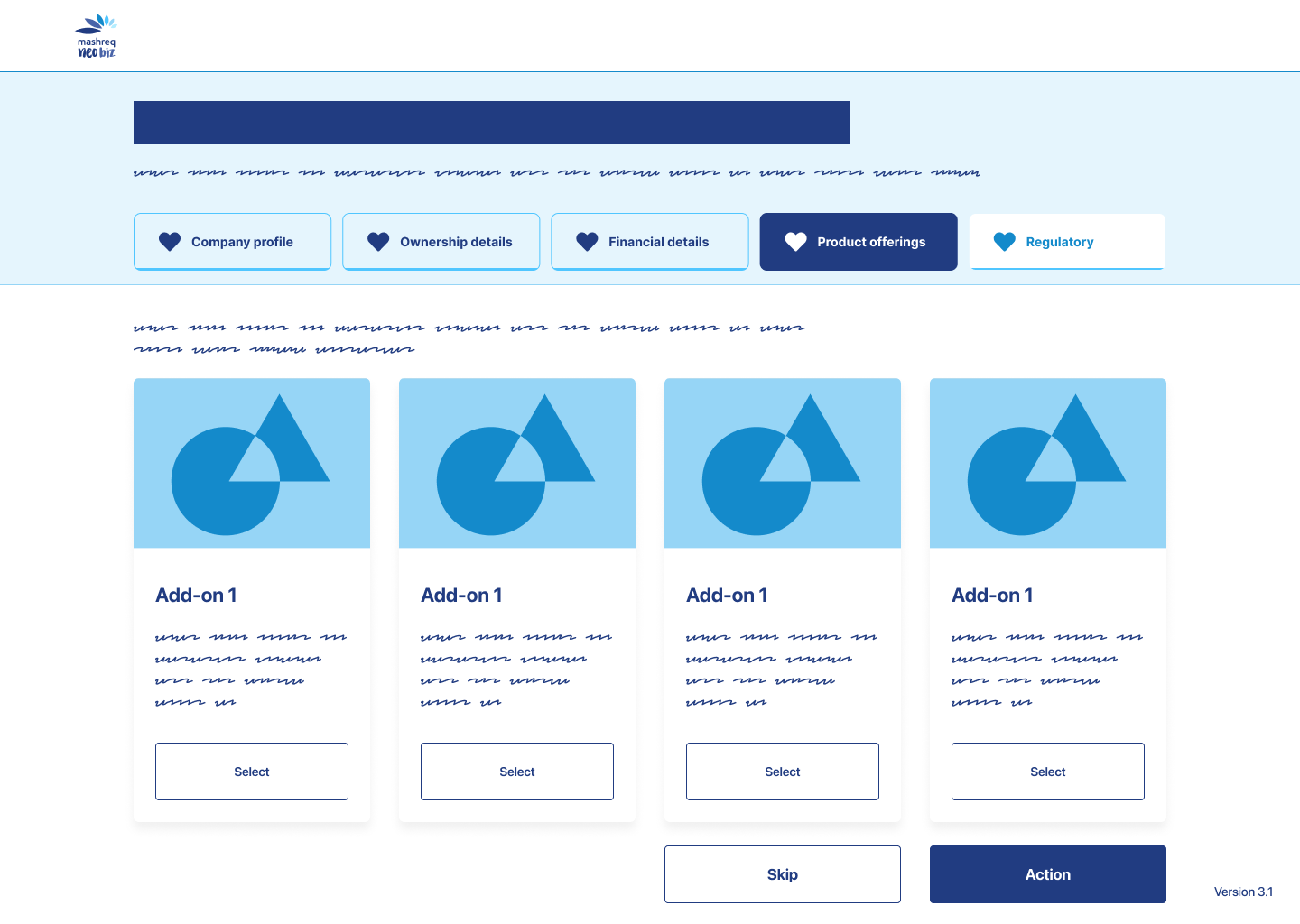

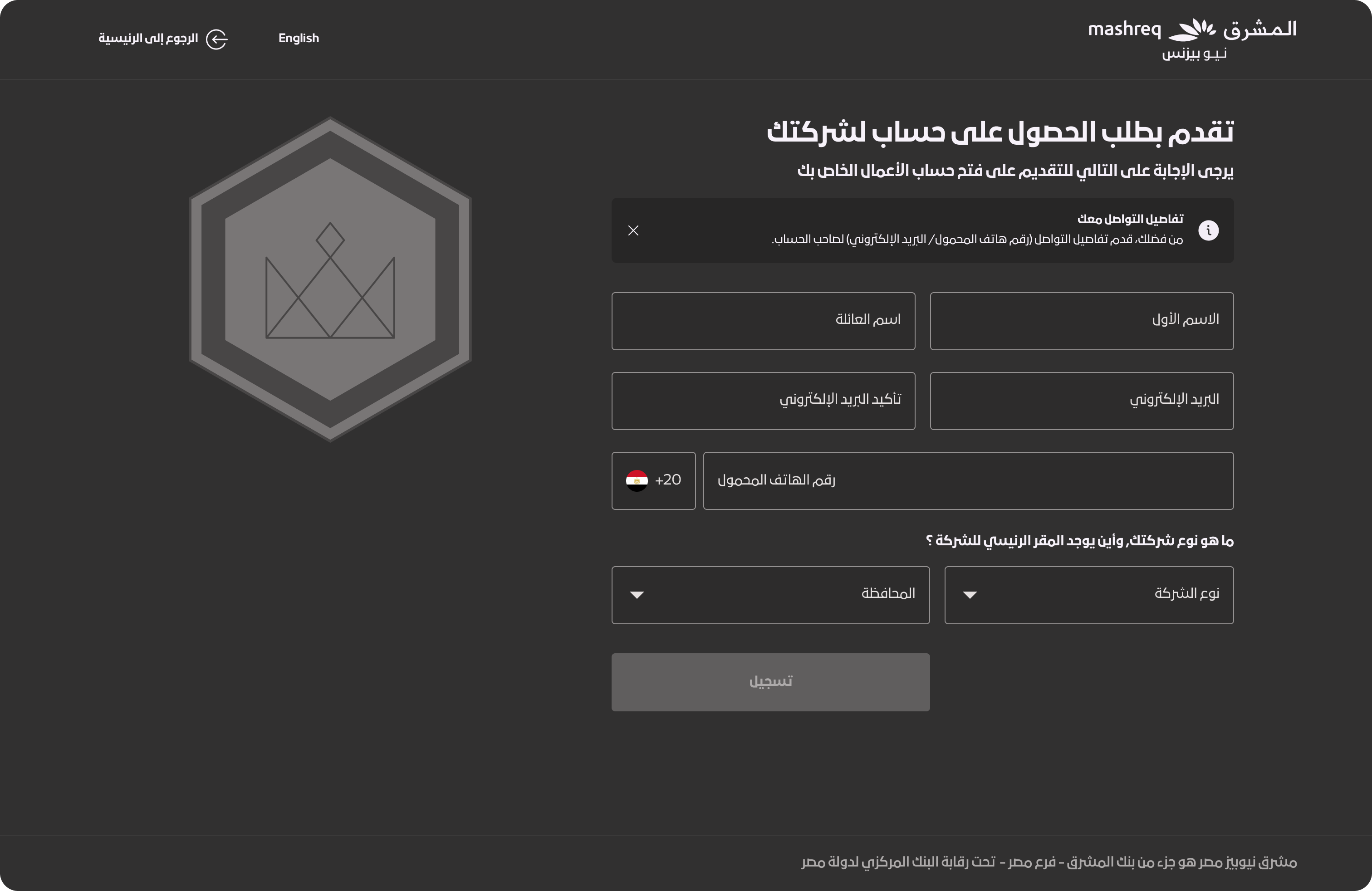

Initial Sketches and Wireframes

We created early sketches and low-fidelity wireframes to visualise the initial design ideas. These wireframes illustrated the proposed solutions. The wireframes were used to discuss and refine the concepts with stakeholders, allowing for feedback and iterations before moving to high-fidelity prototypes.

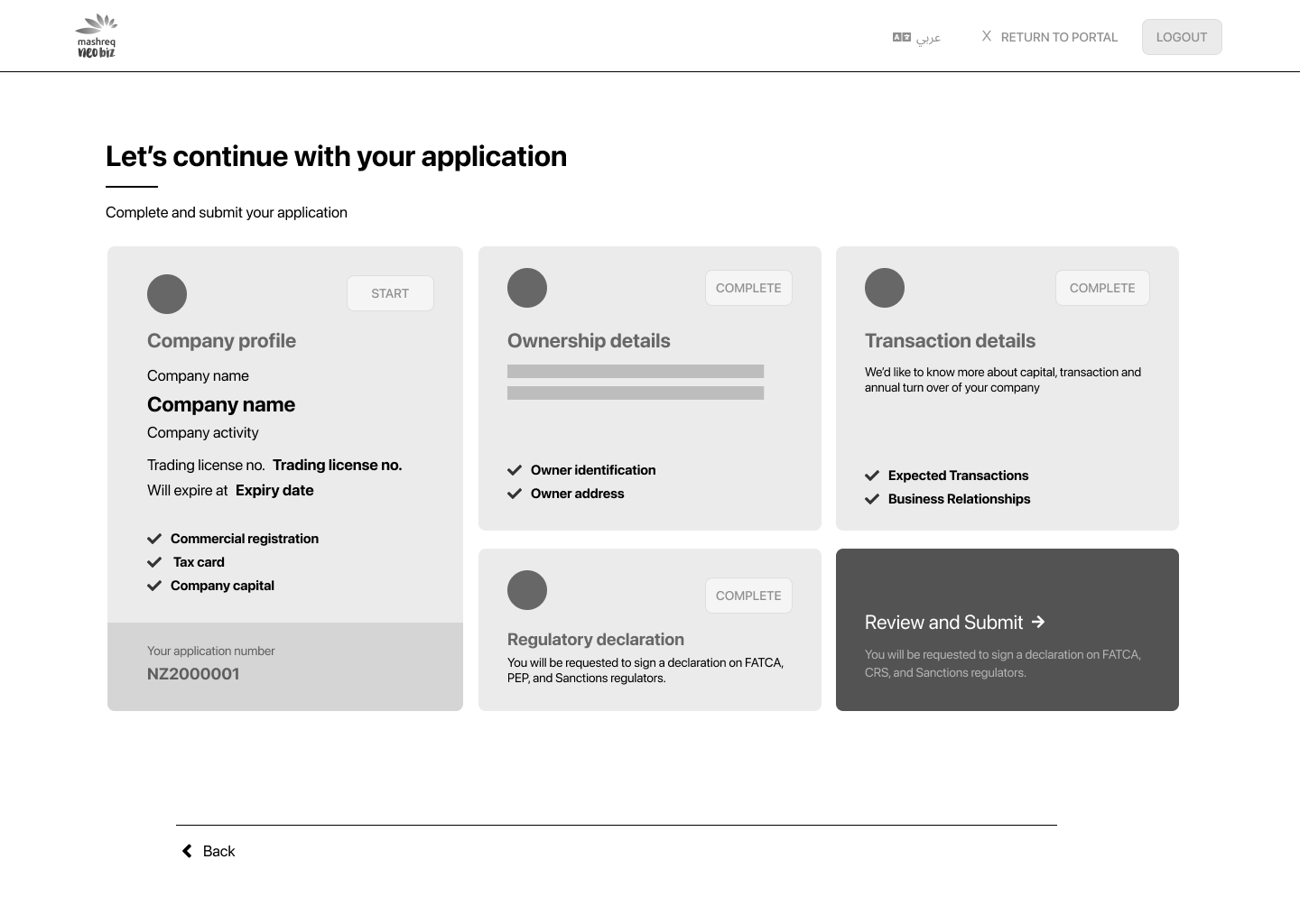

Dashboard

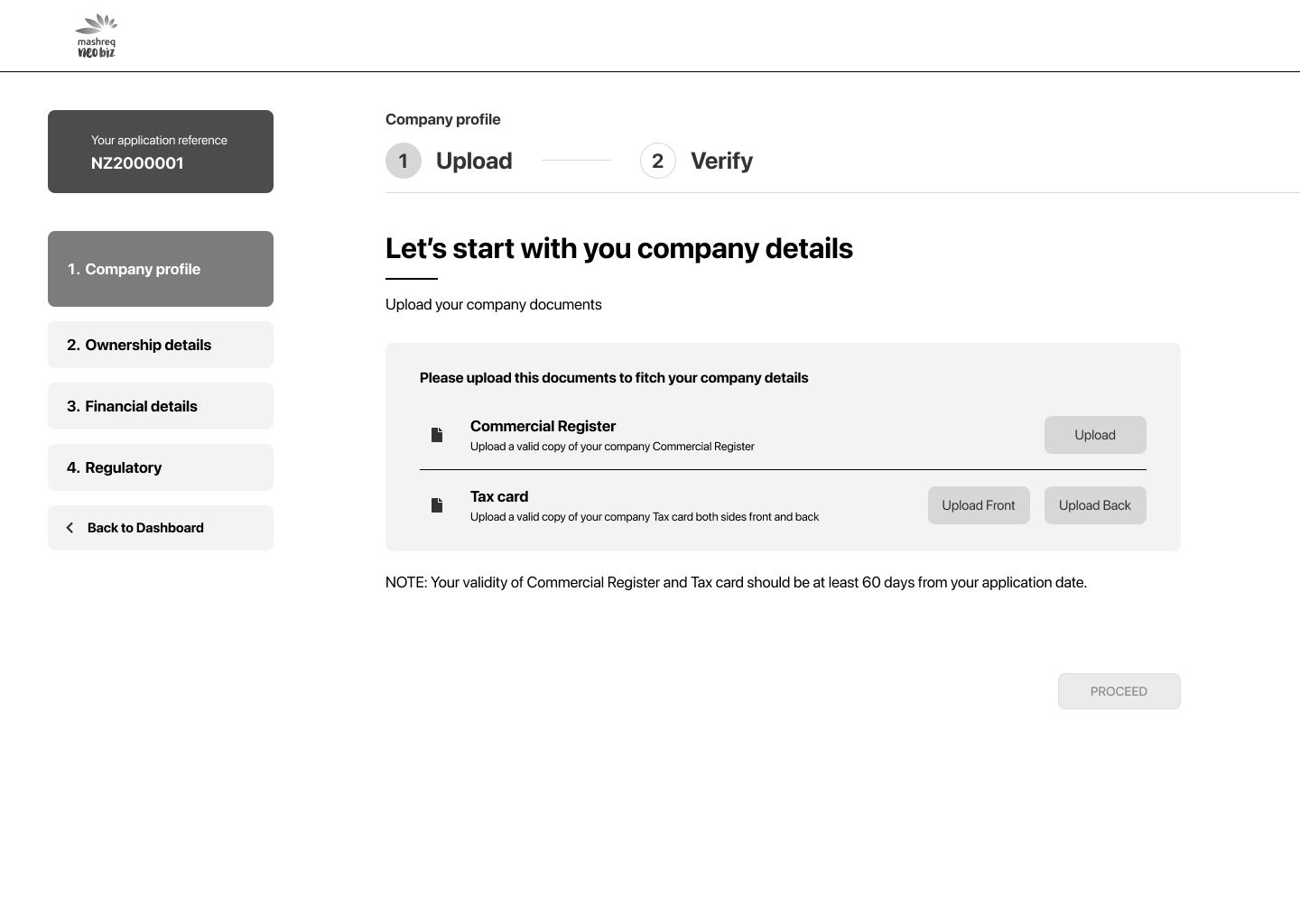

Document upload

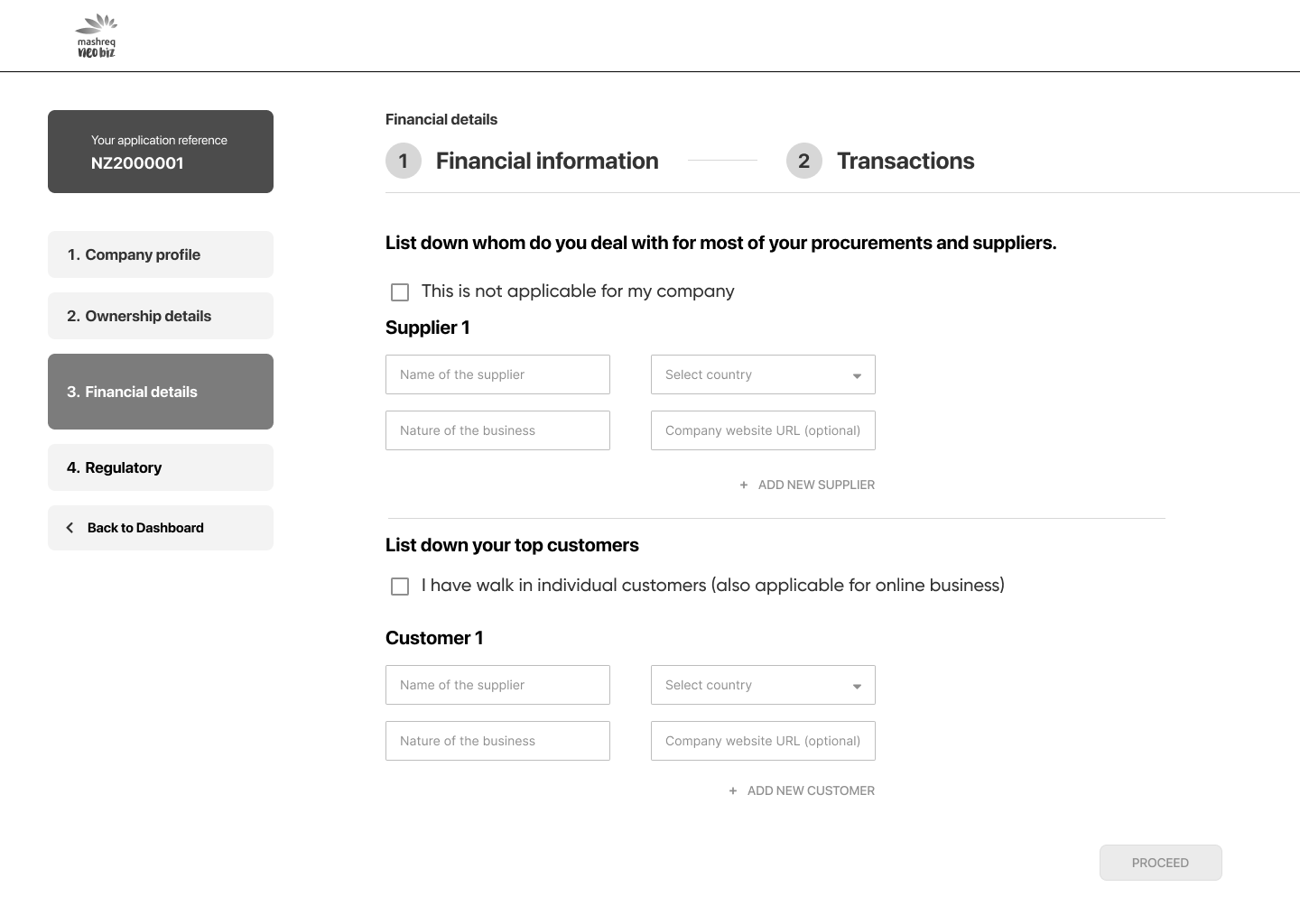

Financial details

Sign up

Confirming details

Addons services

Design in Action

User-Friendly Interface

Design Principles

We adhered to principles of simplicity, clarity, and user-centricity. The interface was designed to be intuitive, with a clean layout and easy navigation to ensure a smooth user experience. Particular attention was given to the document submission process, making it straightforward and efficient, and to the multilingual support, ensuring that users could easily switch languages and access content in their preferred language.

English language version 🇬🇧

Arabic language version 🇪🇬

Secure Authentication

Security Measures

Robust security measures, including multi-factor authentication and data encryption, were implemented to protect user data and maintain trust. The Optical Character Recognition (OCR) system and document verification process was designed with security in mind, ensuring that customer information is handled securely and complies with regulatory standards.

Step-by-Step Guidance

Onboarding Flow

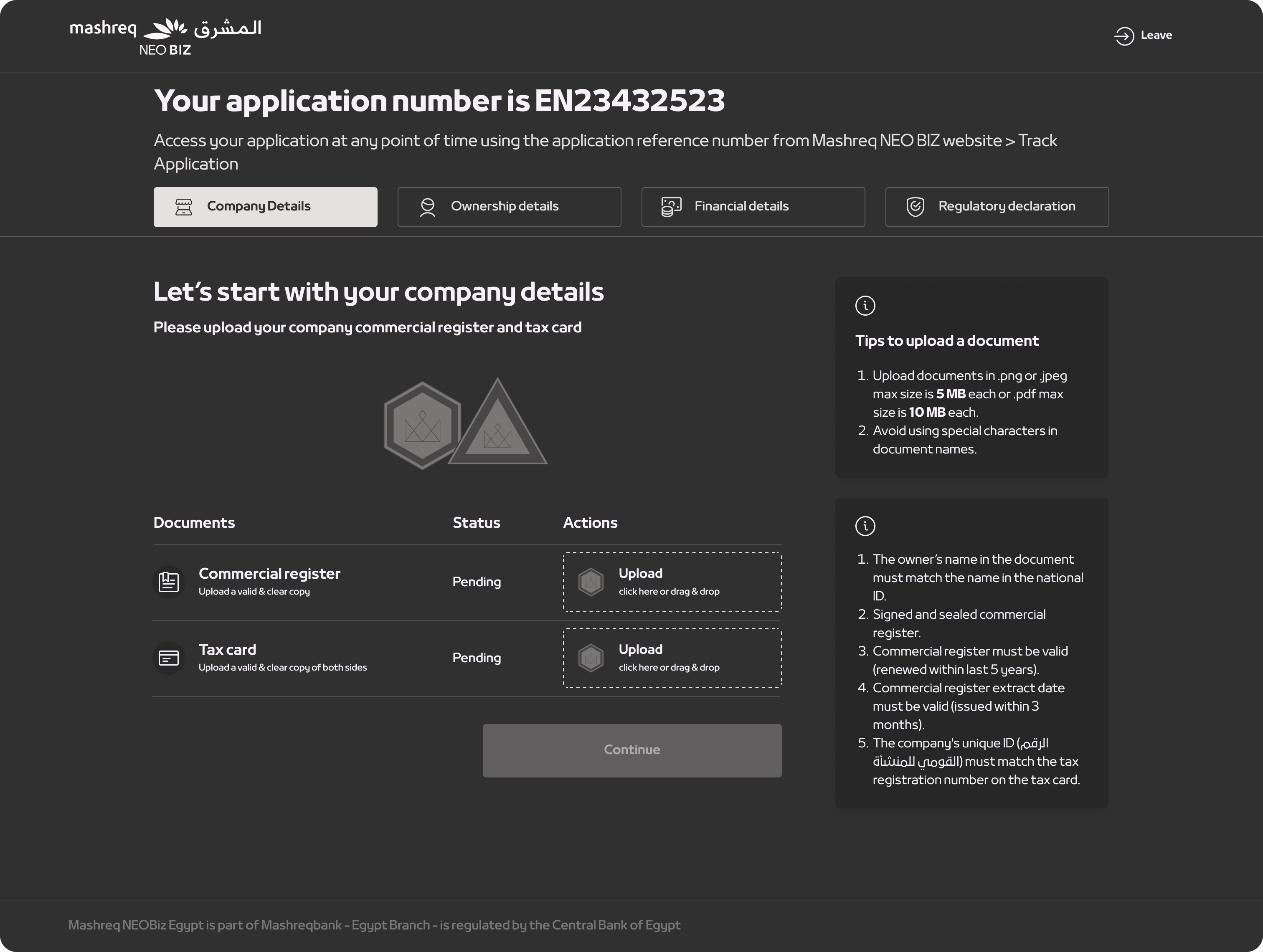

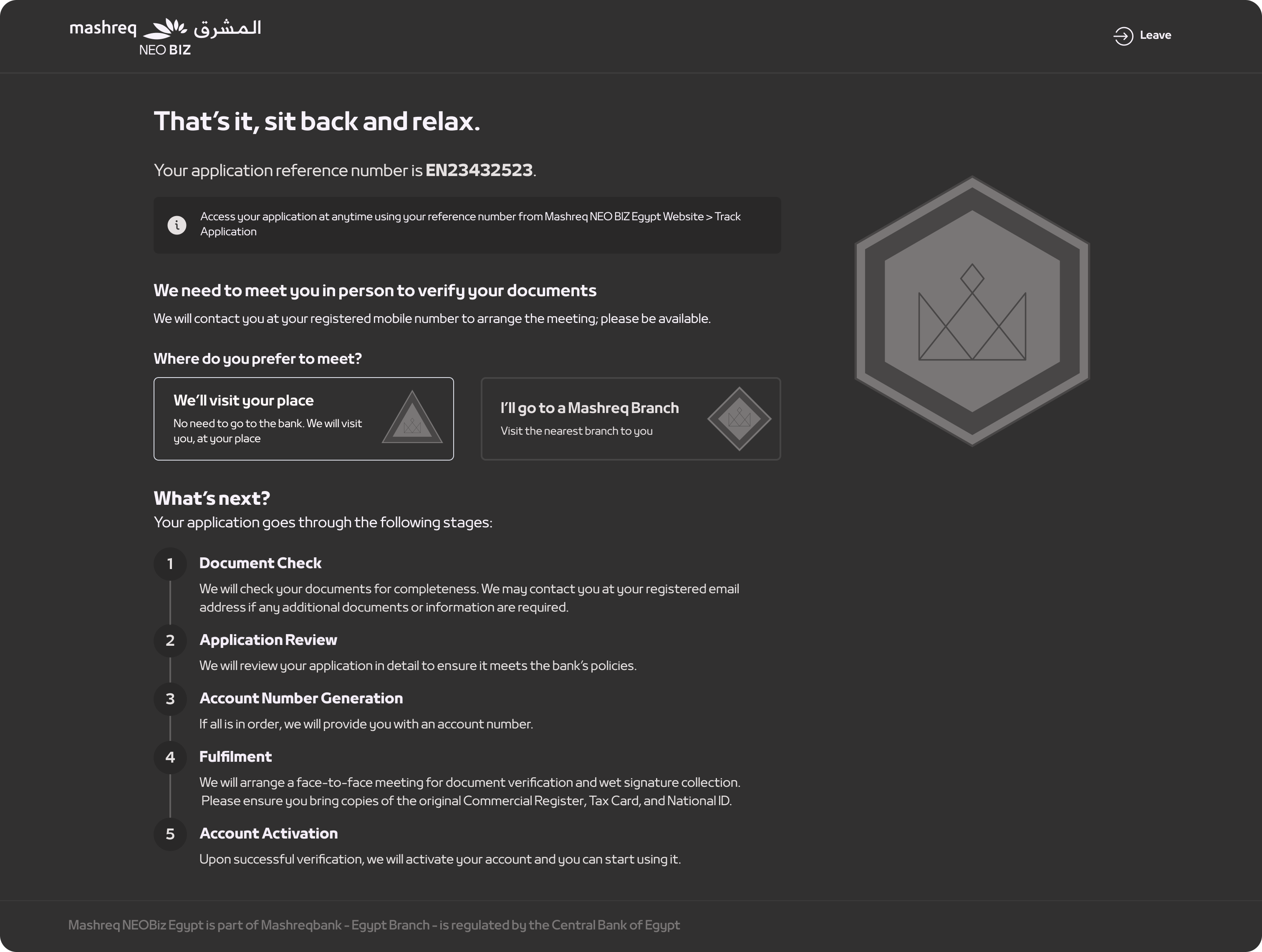

The onboarding process was broken down into clear, manageable steps. Each step included concise instructions, visual cues, and support from the digital assistant to guide users through the process effortlessly.

The document upload step provided clear guidelines on the types of documents required and allowed users to submit files easily.

The flow also included language options at each step, ensuring that users could navigate the process in their preferred language.

Visuals

Visual representations of the onboarding flow demonstrated how each step was designed to be user-friendly and efficient.

Document Upload

Functionality

The document upload functionality was designed to be seamless and user-friendly. Users could easily upload required documents directly through the platform.

The system automatically checked for completeness and accuracy, providing instant feedback and reducing the need for manual intervention.

Comunication

Emailers

To keep users informed and engaged throughout the onboarding process, a series of email notifications were designed. These emailers provided updates on the status of their account opening, reminders to complete any outstanding steps, and tips for using the digital assistant and language options. The communication strategy was crafted to ensure transparency and maintain a high level of customer satisfaction.

Testing

Usability Testing

Methods

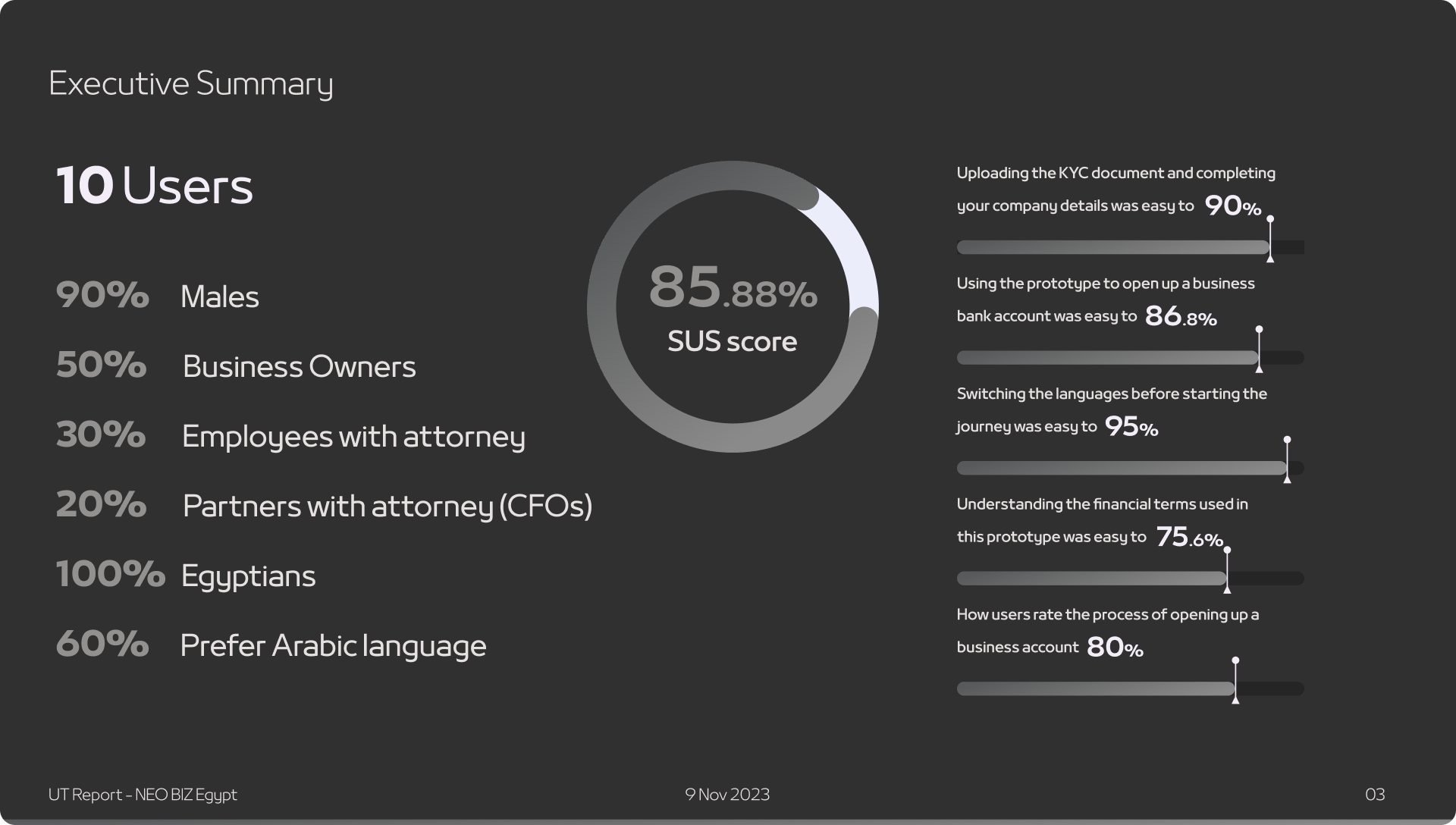

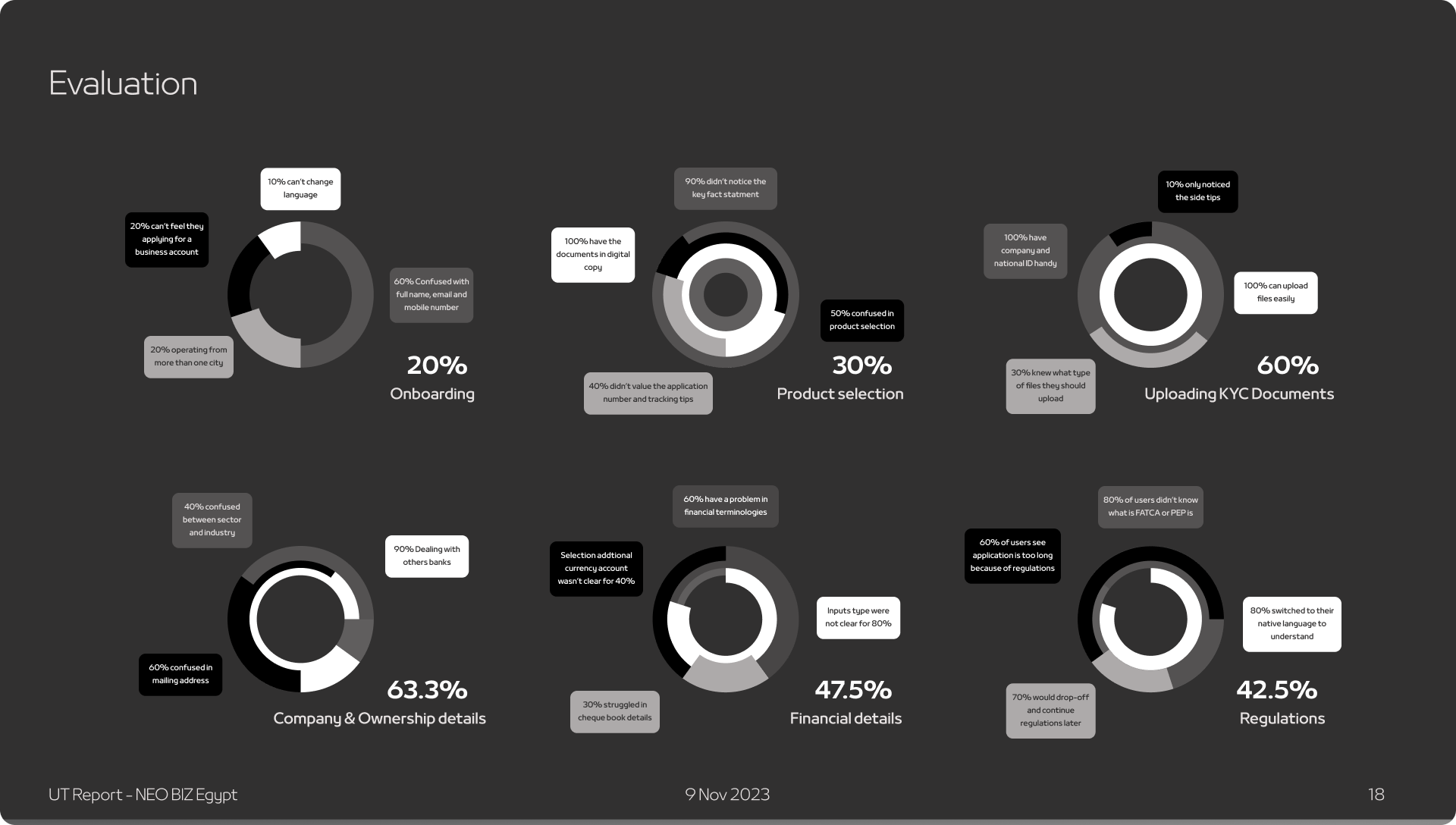

Conducted usability testing with real users to evaluate the effectiveness of the AI-powered document verification, digital assistant, and multilingual interface.

Key Findings

Feedback highlighted the need for minor adjustments in the document upload process and further refinement of the digital assistant’s responses.

Iterations and Refinements

Iterative Design Process

Made iterative refinements based on testing results, including improving the typo to be more accurate, enhancing the digital assistant’s guidance, and decrease irrelevant information request.

Impact

Business impact

Increased Acquisition

Increased Efficiency: The streamlined document verification process and digital assistance led to faster onboarding times, reducing operational costs and improving customer acquisition rates.

Higher Conversion Rates: The platform’s user-friendly design and multilingual support attracted a broader customer base, increasing conversion rates by 30% in the first six months.

Customer Impact

Customer Satisfaction

Enhanced Satisfaction: Customers reported higher satisfaction due to the reduced time and effort required to complete the onboarding process, along with the added convenience of language options.

Increased Trust: The secure, OCR system and clear guidance throughout the onboarding journey boosted customer confidence in the bank’s services.

Conclusion

Summary

The online acquisition transformation for business banking customers in Egypt successfully addressed key challenges in document verification, digital assistance, and multilingual support. The OCR, automated document processing solutions and user-centric design led to significant improvements in onboarding efficiency, customer satisfaction, and overall acquisition rates.

By focusing on the unique needs of the Egyptian market, the bank positioned itself as a leader in digital banking services, catering to a diverse and growing customer base.