Developed a seamless and intuitive mobile app onboarding process tailored specifically for business banking customers in the UAE. This project aimed to enhance user experience, streamline the onboarding process, and increase customer acquisition and retention rates.

Date

2023 - 2024

Role

Product Design, Strategy

Platform

Web Application

Link

2023 - 2024

The context of business banking in the UAE is characterised by a rapidly growing and competitive financial services market, driven by the country’s strategic vision to become a global financial hub.

The UAE’s banking sector is robust, with a high demand for business banking services from a diverse range of enterprises, including SMEs and large corporations. This dynamic environment underscores the importance of a seamless and efficient onboarding process. A robust onboarding process not only enhances customer satisfaction and retention but also plays a crucial role in ensuring regulatory compliance and security. In a region where business banking customers expect fast, secure, and convenient services, improving the onboarding experience is vital for banks to differentiate themselves and build long-term customer relationships.

Create a seamless and efficient mobile onboarding process for business banking customers in the UAE to significantly enhance user experience and increase customer acquisition.

Enhance User Experience

Achieve a user satisfaction score of at least 85% in post-onboarding surveys.Reduce the average onboarding time by 50%, ensuring that users can complete the process within 10 minutes.

Increase Customer Acquisition

Increase the conversion rate of potential customers to active users by 30% within the first six months after implementing the new onboarding process.

Grow the number of new business banking customers by 25% quarter-over-quarter for the first year.

Develop a Mobile App

Launch a fully functional mobile app with the new onboarding process within six months.

Achieve a minimum of 10,000 downloads in the first three months post-launch, with at least 70% of users completing the onboarding process.

The existing onboarding process for business banking customers in the UAE is cumbersome and inefficient. Users face multiple hurdles, such as complicated forms, lack of clear guidance, and lengthy verification processes, leading to a high drop-off rate during onboarding.

Business banking customers require a streamlined, intuitive onboarding process that minimizes time and effort. They seek clear instructions, secure data handling, and the ability to complete the process with ease, preferably from a mobile device.

We employed a mix of qualitative and quantitative research methods, including surveys, in-depth user interviews, and usability testing sessions. These methods were chosen to gather comprehensive insights into user behaviors, preferences, and pain points.

The research revealed several critical pain points: users found the existing onboarding forms too lengthy and confusing, security concerns were prominent, and there was a significant need for real-time assistance during the process. Users also preferred a mobile-first approach for convenience.

By analysing the onboarding processes of leading competitors, we identified best practices and areas where our process lagged. Competitors with streamlined, user-friendly onboarding flows had higher user satisfaction and lower abandonment rates, highlighting the need for an improved user experience.

Based on the research findings, we developed detailed user personas to represent our target audience. These personas included demographics, goals, pain points, and typical behaviors, providing a clear picture of our users.

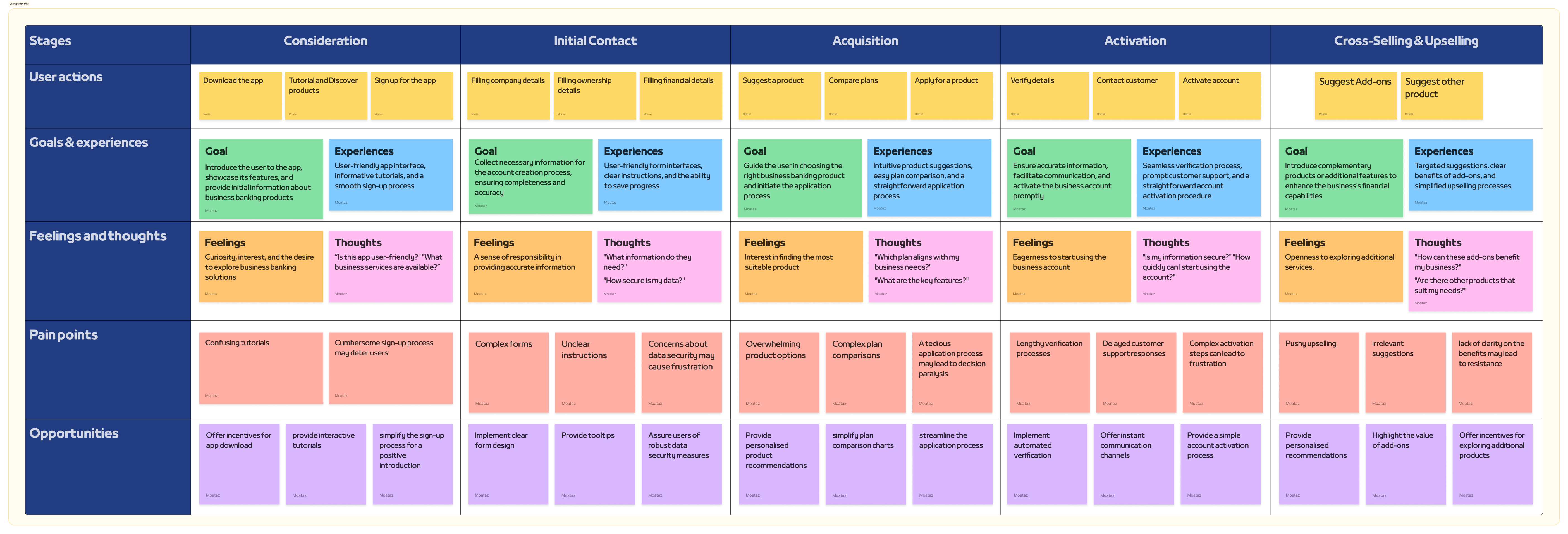

We mapped out typical user journeys to understand the steps involved in the onboarding process from start to finish. This helped us identify critical touchpoints and areas where improvements were necessary.

Initial ideas and concepts were generated through collaborative brainstorming sessions with the team. These sessions focused on innovative solutions to address the identified user pain points and improve the overall onboarding experience.

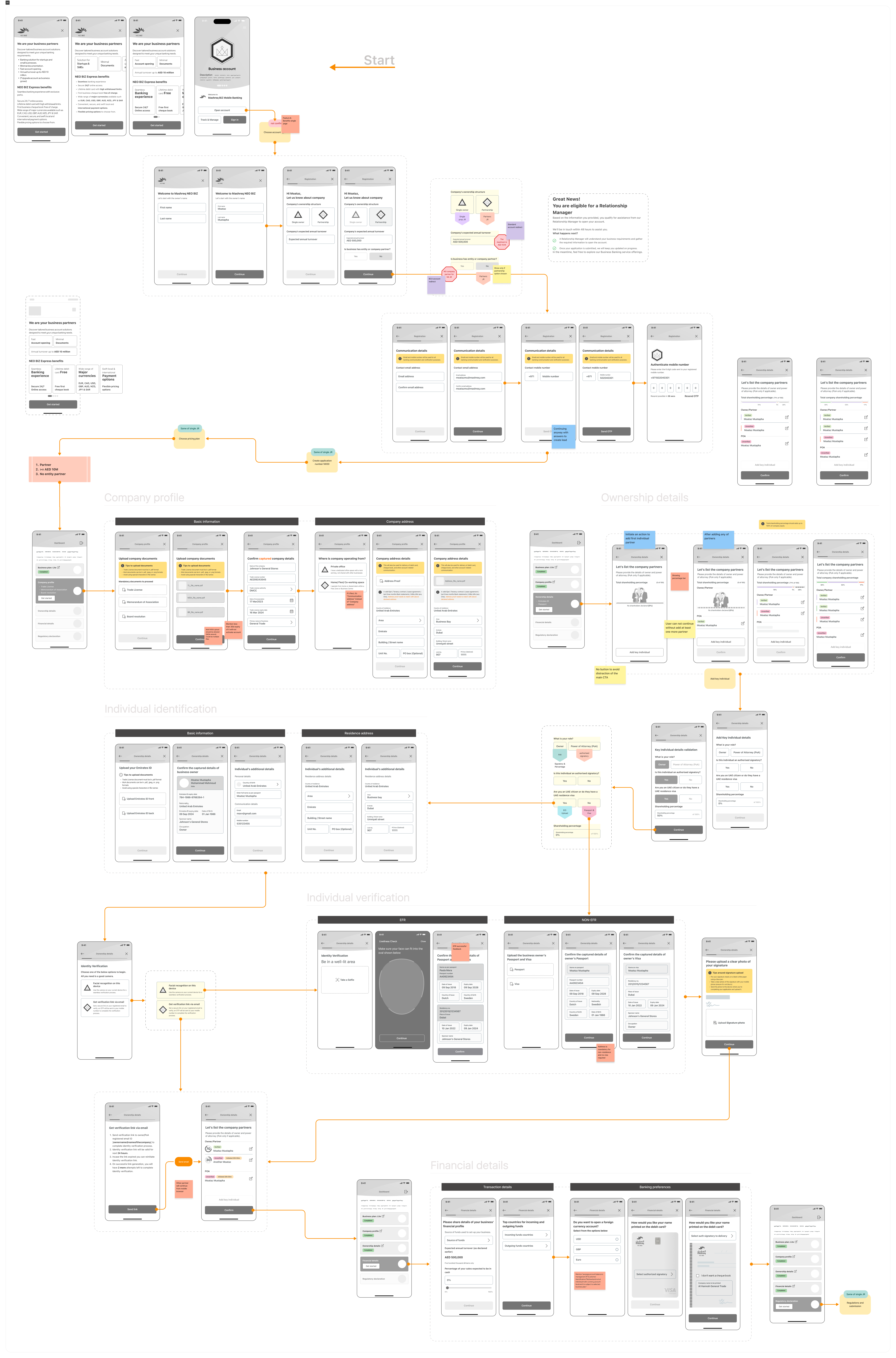

Early sketches and low-fidelity wireframes were created to visualise the initial design ideas. These wireframes were used to discuss and refine the concepts before moving to high-fidelity prototypes.

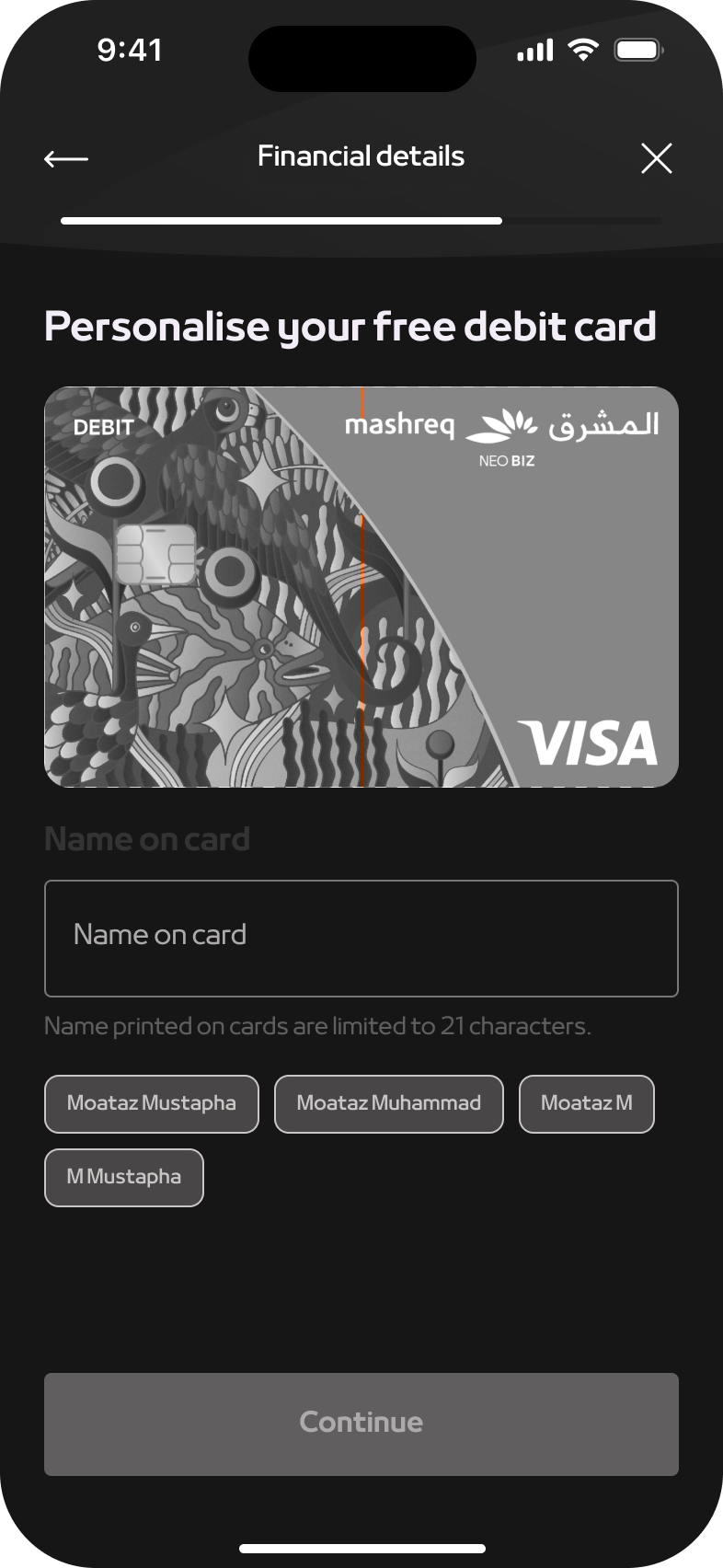

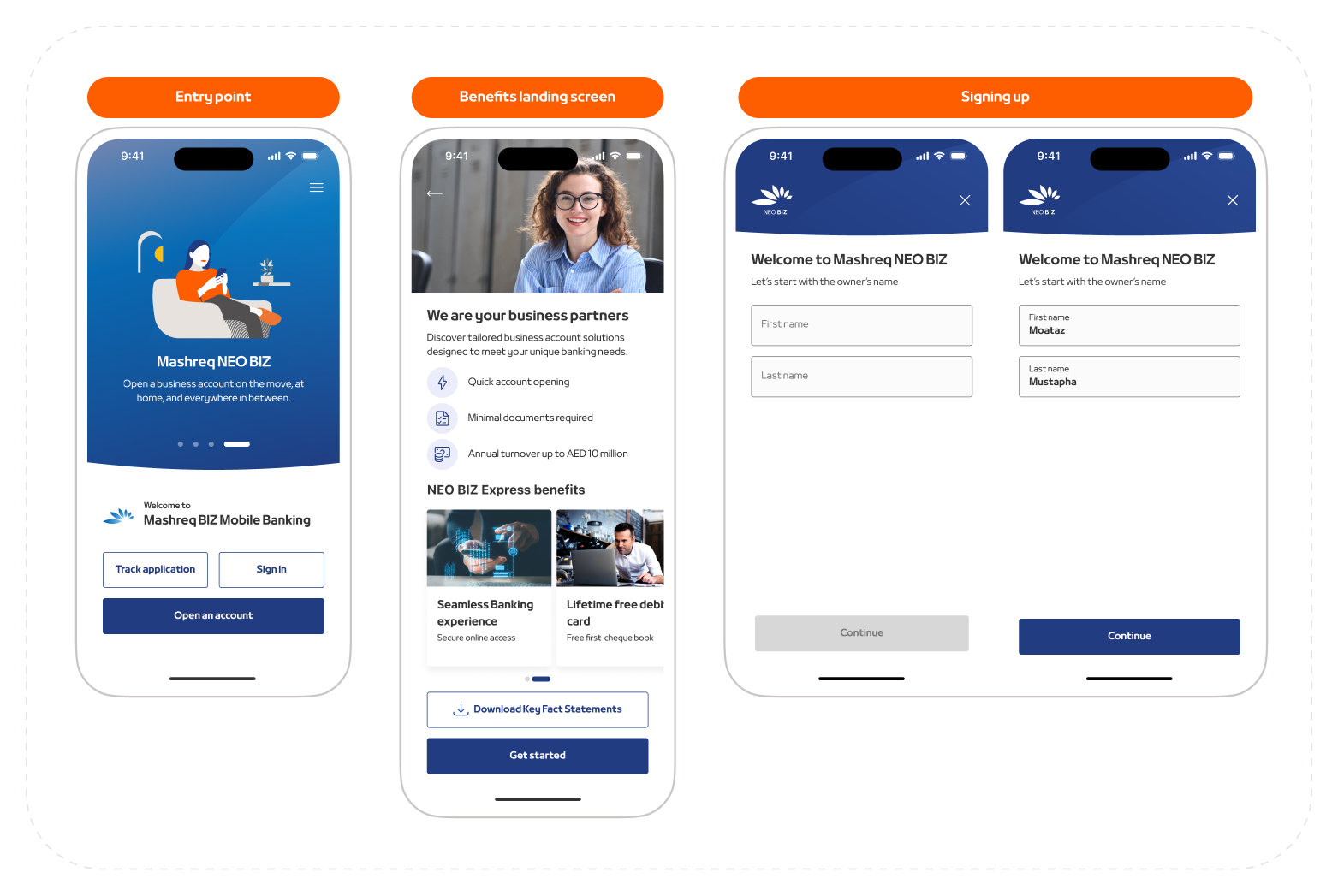

We adhered to principles of simplicity, clarity, and user-centricity. The interface was designed to be intuitive, with a clean layout and easy navigation to ensure a smooth user experience.

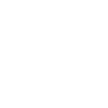

Robust security measures, including multi-factor authentication and data encryption, were implemented to protect user data and maintain trust.

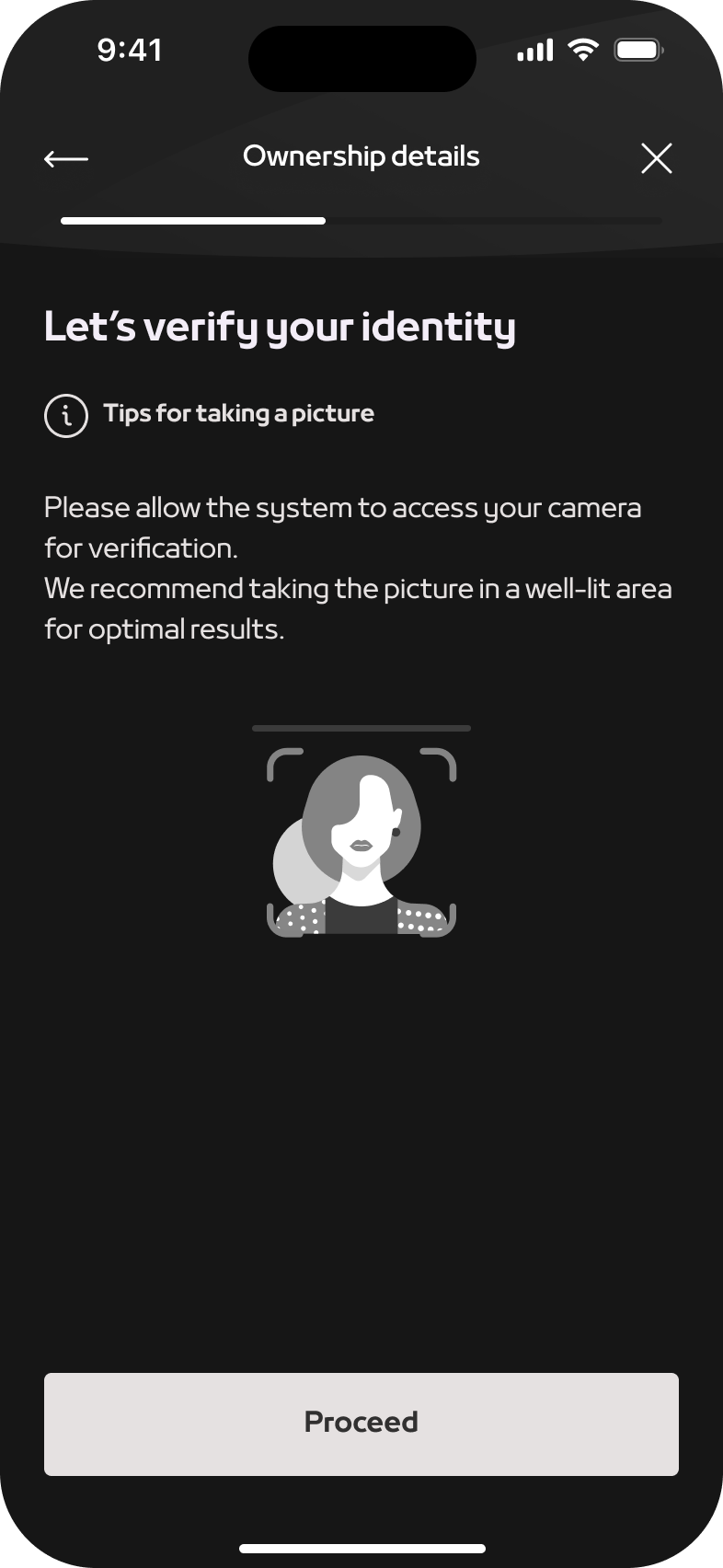

The onboarding process was broken down into clear, manageable steps. Each step included concise instructions and visual cues to guide users through the process effortlessly.

Users can easily upload required documents directly through the app using their device’s camera or file upload options. The process was made seamless to reduce friction.

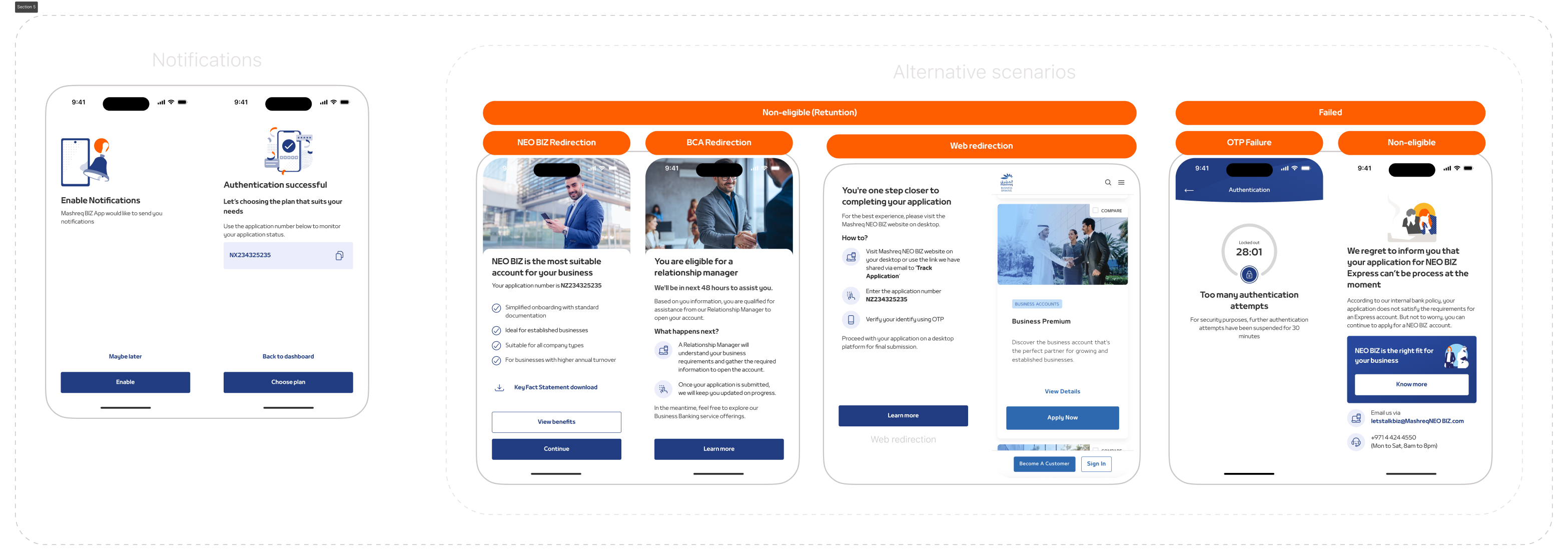

Real-time notifications keep users informed about their application status, providing updates at each stage of the onboarding process. This feature ensures transparency and reduces user anxiety.

Usability testing involved real users interacting with the prototype. We used methods such as think-aloud protocols, task completion rates, and post-test interviews to gather feedback on the design’s usability.

Feedback from usability testing highlighted areas for improvement, such as simplifying certain form fields and enhancing visual cues for better navigation. Users appreciated the clear instructions and secure authentication measures.

Based on user feedback and testing results, we made iterative refinements to the design. This included tweaking the interface, improving the onboarding flow, and addressing any usability issues identified during testing.

The implementation had a great positive effect on the business: it facilitated an easy, smooth onboarding process which noticeably improved the customer acquisition rates. Also, with the new mobile app, the bank could gain more business banking customers, especially in the UAE where the usage of mobile devices is widespread.

The user-friendly interface and steps taken by the user to minimize errors for the users helped reduce the inquiries with customer support, while saving money and bringing operational efficiencies.

Easy uploading of documents and instant notifications reduce the hassle of customers and improve customer satisfaction, which results in higher customer retention rates.

A seamless and intuitive experience. The user-friendly interface and clear instructions made it easy for business banking customers to complete the onboarding process quickly and efficiently.

The secure authentication measures ensured the safety of their personal and business information, enhancing their trust in the bank. The ability to upload documents directly through the app and receive real-time updates on their application status added convenience and transparency to the process.

Overall, the improved onboarding experience led to higher satisfaction levels among customers, fostering loyalty and encouraging them to recommend the bank’s services to others.

Successfully achieved its primary objectives. The streamlined and efficient process enhanced the user experience, resulting in higher customer satisfaction and retention rates. The increase in customer acquisition rates and the operational efficiencies gained through the reduced need for customer support demonstrated the business impact of the new process. By focusing on the needs and expectations of business banking customers, the bank was able to create a user-friendly and secure onboarding experience that set it apart from competitors and positioned it for continued growth and success in the market.